Credit cards - what do they mean in a COVID-19 world?

Justin Chow

Score points and earn bank cred

Young people, credit cards and a pandemic-induced economic recession; sounds like a recipe for disaster. Credit cards can be seen in a pretty negative light - sometimes for good reason - but it doesn’t have to be that way, particularly as we adjust to life in lockdown with new ways of living, spending and consuming.

We don’t want to encourage getting credit, particularly in these turbulent times. However if used sensibly, a credit card can propel you through life (and may even have some COVID-19 benefit) in more ways than you realise. BUT, this relies on your discipline, self control and commitment to the cause.

So before we go any further, I want to ask you a few questions.

In both pre-coronavirus life and now, do you:

- Regularly find yourself spending more than you should/more than you have?

- Have trouble monitoring your spending?

- Already have a lot of debt?

- Struggle to pay for basic expenses such as food, bills, etc.? (either due to income not being high enough or overspending on other things)

If your answer to any of the above was ‘yes’, then there’s a good chance that a credit card might not be right for you at this point in time. That doesn’t mean it’ll never be right for you, but you should review your budget and expected impact of COVID-19 before venturing down this route. Our Budgeting topic in this series is a good starting point!

If you’re sure you’re good to go, let’s get to it. In this topic we’ll cover:

- The many benefits (and dangers!) of a credit card

- Choosing what’s right for you

Dating your bank

Your first time is always pretty exciting. I remember mine was for 50,000 bonus points with a sweet first year annual fee waiver. Since then, I’ve never looked back and have turned into an infamous serial point hunter. This is even more relevant now if you’re going to town on the online spending and orders while in lockdown - make sure you get the benefit of points too!

I only had one thing on my mind when I opened my first credit card, and that was points. However, I’ve come to learn there are other benefits to a credit card - and I’m not just talking about an emergency source of funds.

A good credit score - we’ve all heard of it, but what does it actually mean and how do you build one? Any time you apply for a credit card, mortgage or other loan, your credit history comes into play. Having a good score can be the difference between getting approved or declined, and may even influence the rate you get. If attracting banks is like online dating, then your credit score is your dating app profile - banks use this to decide which way to swipe. Is your creditworthiness hot or not?

Opening a credit card will kick off your credit (bank dating) history. So long as you make all your repayments on time, you’ll boost your credit score (bank dating profile) and make you more attractive to those exclusive banks. It may not seem like a huge deal now, but it can save you a ton of stress later in life (and maybe even some money too!).

Beyond this, a credit card allows you to momentarily spend the bank’s money. When you make a credit card payment, there’s some time before you need to pay that money back. In that time, you can keep your funds stashed in a savings account earning you interest. Right now, getting those extra savings in always helps!

Alright, I’m sold - now tell me which one to get!

Not so fast! This may all sound great but it’s important to revisit our earlier point. A credit card is a great tool but only if you trust yourself to pay on time. If not, you’re staring down the barrel of the exact opposite of what you’re after; debt and a tarnished bank dating profile.

Some general rules of thumb:

- Never spend more than you can actually afford – even if the money (credit) is there ‘to be used’. It’s for this reason I also recommend against taking out a personal loan in general, but especially for things like travel and everyday spending.

- Avoid withdrawing cash using your credit card – whether taking cash from an ATM or transferring to a transaction account, the banks are going to hit you with a fee (cash advance fee).

- Manage your credit limit – chances are your credit limit will be more than you’ll actually need. Don’t be tempted by this; keep the limit high enough to meet your spending and emergency needs but low enough so you manage the risk of racking up a ton of debt!

When it comes to credit cards, banks often make money off customers in two key ways - through annual fees and by charging interest on overdue balances. Fortunately, there are plenty of ways to avoid both of these!

Fee free or rewards? Porque no los dos?

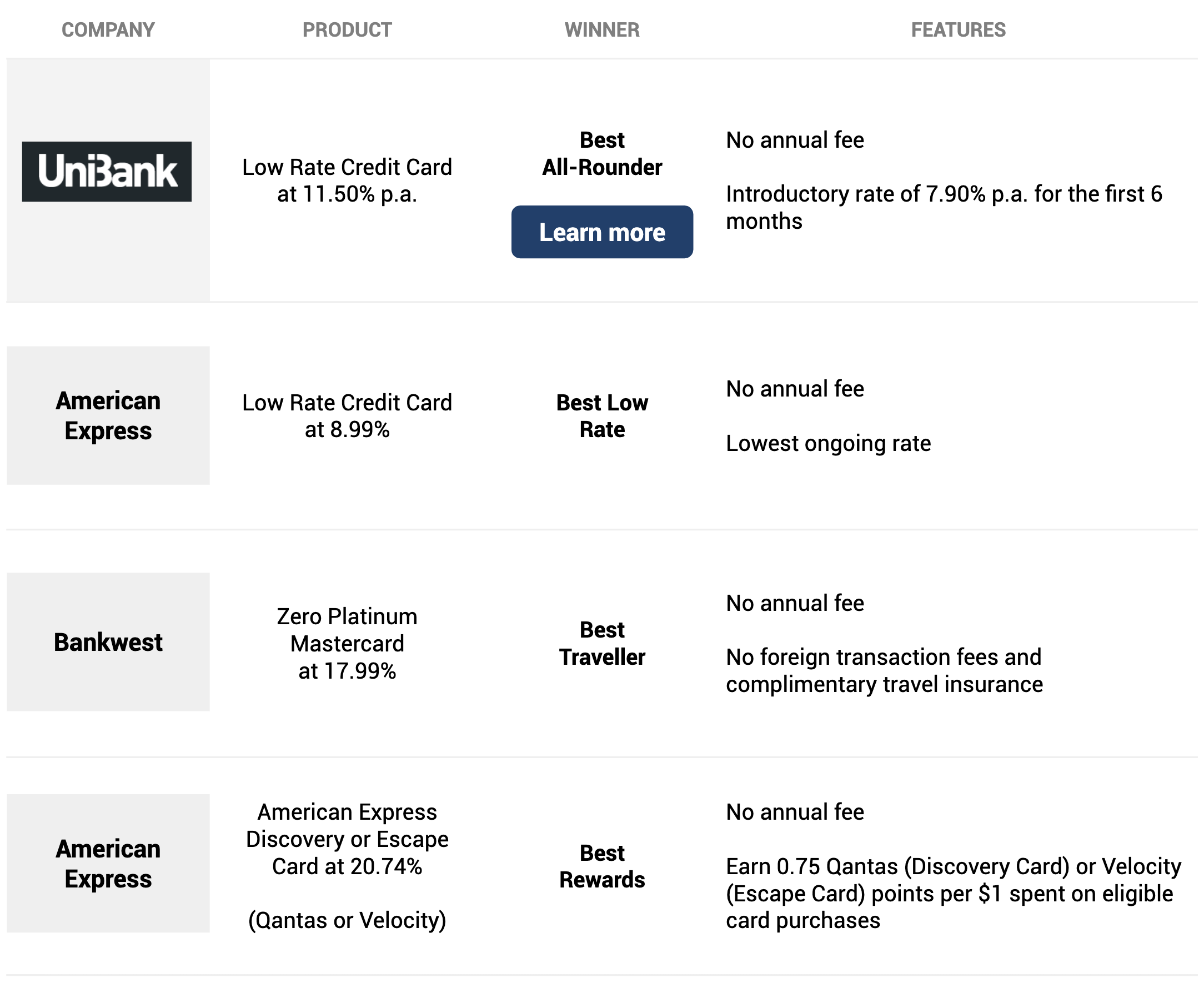

Right! Time to figure out which credit card is right for you. There are a ton of options out there, but we’ve split some of our favourites into these two categories:

Price is right

Generally, I believe you should avoid paying interest at all costs - it undermines all of the benefits and doesn’t help you in any way whatsoever. So theoretically, the interest rate on your credit card should be irrelevant.

Regardless, there may be the odd occasion where there’s a good reason you’re having to pay interest, and if this is the case, then having the lowest rate credit card will ensure you’re giving away as little as possible to the banks. Since many of these low rate cards are limited in the extra benefits they provide, it’s best to look for one with a low (or no) annual fee

The 'Best All Rounder' goes to UniBank, with an attractive low introductory rate, a reasonable ongoing rate, no annual fee, and the upside of being more widely accepted than the Amex cards. For more information, check it out below:

For the lowest ongoing interest rate and no annual fee, Amex is our winner for 'Best Low Rate'. They also get the prize for 'Best Rewards', where you can earn airline points without having to pay a fee – a rarity in the market.

Bankwest provides a card with no annual fee and no foreign transaction fees, but it’s the complimentary travel insurance (typically only offered on more premium cards), which elevates it to the 'Best Traveller' in the cohort.

More than money

Points, points, points! There’s a certain thrill to seeing a wad of bonus points hit your account, but even this is something you should try and plan for. With numerous point schemes on offer, it’s important to consider which is most suitable for you.

Try to limit the number of schemes you spend your time and money accumulating points across - this should help you build your balances faster and maximise your rewards in the longer term (think round the world business class, all paid with points!). I’d also recommend going with one of the frequent flyer programs rather than a specific bank’s reward program – it’ll make it easier to continue building your points balance in the long term, even if you switch to other banks.

Many card offers come with annual fee discounts or waivers for the first year, so one common tactic to utilise is to open a card, earn the bonus points available in the first year, then close it before the full annual fee kicks in for the second year. One thing to be conscious of when it comes to opening multiple cards is that this all gets recorded on your credit file each time you submit an application and is available for banks and credit providers to see on your future loan requests (don’t forget about your bank dating profile!).

Beyond points, many cards also come with a suite of other perks, such as complimentary insurance, a concierge service and discounts with various retail partners. As with everything (including the points), make sure you read the fine print, so you don’t miss out on the benefits due to a technicality!

These offers are all for a limited time only, so be sure to constantly check what else is available at the time you’re searching around.

ANZ takes out the 'Best Points Hack' title with its current bonus points offer for an annual fee of $425, with $275 cash back if you meet the requirements. The cash back and bonus points are only available in the first year, so you’re better off closing before you reach the anniversary of your card opening.

For 'Best Everyday Rewards' Coles gives you a great earn rate, plus the occasional cash discount on your shopping as you earn and redeem your points. The card will also serve you well while you travel, with no international transaction fees, complimentary insurance and access to a 24/7 concierge service.

If you’re after something that you can keep for more than just the first year at a reasonable ongoing annual fee, the Qantas Premier Everyday fits the bill for the 'Best Low Fee', with a $29 reduced fee for the first year and $49 p.a. thereafter.

Four ways to reduce your credit card balance

When used correctly, credit cards are a great way to build your credit rating and give you the freedom you need to make important purchases.

New credit reporting rules are making it all the more important to be responsible with your credit cards. Here’s an overview on how Comprehensive Credit Reporting (CCR), sometimes referred to as positive credit reporting, and your credit card balance go hand-in-hand.

Check out the advice above to read more about:

- A brief overview of credit cards in Australia

- How Comprehensive Credit Reporting (CCR) will affect you

- Tips for managing your credit card balance

You can read more about simple ways to keep your credit card debt in check here.

* Membership eligibility applies to join the bank. Membership is open to citizens or permanent residents of Australia who are current or retired employees, graduates and students of an Australian university or family members of members (i.e. shareholders) of the Bank.

UniBank is a division of Teachers Mutual Bank Limited ABN 30 087 650 459 AFSL/Australian Credit Licence 238981.

Wrap up

Now you know that there’s more to credit cards than just points, you’re ready to search for the one that’s right for you! Good thing you’ve got all that extra time now in lockdown. Just remember, discipline and self control are critical, avoid paying interest at all costs, and steer clear of personal loans!

Stay tuned for upcoming topics or check out or other useful articles here. We’ve got plenty more gold to help you make the leap from top student to top professional!

Got feedback? We’d love to hear from you! Shoot us an email at [email protected]

Author by-line

Not signed up to The Launchpad yet?

Subscribe below to get the full experience!

Disclaimer: The information provided in this topic is general in nature only and does not constitute personal advice. The information has been prepared without taking into account your personal objectives, financial situation or needs.