What's It Like to Be a Graduate Trader in Australia?

Frances Chan

Here are some snapshots of life as a trader, brought to you by real graduate traders themselves.

What are graduate programs at trading firms like?

Expect at least 3-6 months of training, where you'll study foundational concepts and practice trading, usually in a simulated environment.

Here's what grads say about the graduate programs at various companies around Australia.

Optiver

📣 Hear from a grad

We kicked off the program with 12 weeks of training. This consisted of a combination of options theory, coding, and systems knowledge for the first two weeks, with all grads (trading/risk/research/dev). The trading team then split out and did a deeper dive into options and trading theory, before trading in a simulation environment for the last five to six weeks. [...]

After the 12-week training program, you move into a graduate role in one of the trading teams. We then commence another three months of “dual trading”, where we trade in the live market on our own, with small risk limits. The simulation trading prepared us very well for this, as it was a very easy transition from practice trading to trading with real money. – Graduate trader @ Optiver

VivCourt

📣 Hear from a grad

As a graduate working at Vivcourt, my first ten weeks consisted of a training program in which I was taught finance theory, learnt the mathematics behind the products we trade and played a bunch of trading games. – Delta1 Trader @ VivCourt

Maven Securities

📣 Hear from a grad

Learning the basics and the theory behind trading options takes about 6-12 months of training before you actually get to do any real trading. Once you understand the market and the systems and tools well enough then the job gets much easier and more enjoyable but the responsibilities become much greater as well. – Trader @ Maven Securities

The graduate scheme was a diverse and comprehensive introduction to all of the different aspects of trading. At the start of the programme, we followed a packed schedule including theory lessons, regular mock trading exercises, shadowing on the trading floor, coding projects, and a wide range of sessions of things like the markets we trade, different styles of trading, important soft skills, and more. All of this was led by senior traders with many years of industry-leading experience and insight which they were keen to share with us. Within 3 months of starting, we were each responsible for trading our own junior book, using tools we had built and, most importantly, taking a real risk. – Graduate trader @ Maven Securities

Citadel Securities (Get sent to New York!)

📣 Hear from a grad

I joined Citadel Securities as a trader when it just started its operations in Sydney, and really enjoyed the opportunity to participate in a global training program for two months in New York where I met many new joiners from around the world before returning home. Meeting the other new joiners and learning from the American traders was an invaluable experience. – Trader @ Citadel Securities

What does a trader do on a typical day?

The day of a trader can be divided into three parts: before markets open, after markets open, and after markets close.

Before markets open

Traders typically arrive a couple hours before their markets open. During this time, they'll review the news from overnight, check out any positions left open from the night before, and attend team meetings where they might discuss how they want to trade for the day.

📣 Hear from a grad

In the morning I catch up on the news from around the world overnight. Based on the news, we consider what the market conditions will be like today and what different scenarios may play out and how that will influence our pricing. For example, if employment data is released, what will that do to the market? – Options Trader @ Optiver

During market hours

This is when the trading magic happens and things get intense.

📣 Hear from a grad

As a trader, I [try] to find an edge in the market and capture it. During the market session, this means synthesising a multitude of signals to come up with the right trade at that moment and then guiding our systems towards executing it. – Index Options Trader @ Optiver

After markets close

At the end of the day, traders will review their trades and work on ways to improve their tools and processes.

📣 Hear from grads themselves

After the close, I’ll typically analyse the performance of the day, grab some tasty dinner from the kitchen and then head home. – Graduate trader @ IMC

Time to wind down for the day! We close out of any existing positions as desired, assess risk metrics for holding our overnight positions and send out a daily report detailing how well we traded for today. For every trade that we do, there is a lot of time spent at the end of day analysing it! There is no such thing as good enough, we always want to be one step ahead of the game. – Graduate Junior Trader @ Exponential Trading

Of course, what you actually do at a trading firm will depend on your specific role, which brings us to the next section.

What are the different roles at trading firms?

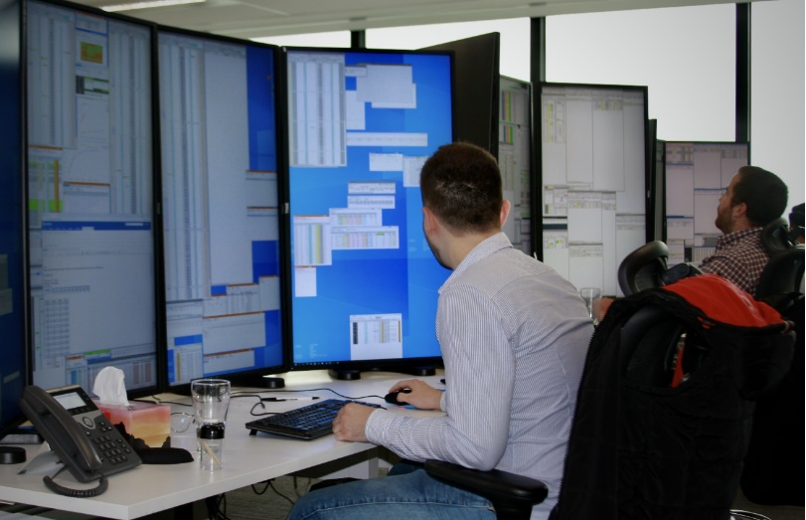

#1 Screen traders

These traders primarily use computer screens to execute their trades.

- They're the digital warriors of the trading world, using charts, indicators, and real-time news feeds to make their decisions.

- They might trade anything from stocks and bonds to commodities and currencies.

Photo courtesy of Maven Securities

Photo courtesy of graduate trader at Tibra Capital

Photo courtesy of Trainee Trader @ Eclipse

Photo courtesy of a Trainee Trader @ Eclipse

#2 Wholesale traders

Wholesale traders deal in large quantities of financial instruments, often acting as intermediaries between institutions.

- They're like the wholesalers in a marketplace, buying and selling in bulk.

- They usually have a deep understanding of both the demand and supply sides of the market and often deal directly with other institutional players rather than through public exchanges.

For example, if you work on the market-making side of things, you'll work a lot with external parties like brokers trying to buy and sell things on behalf of clients.

📣 Hear from a grad

I spend a lot of my day working with external [parties] to provide prices, and liquidity and negotiate large trades. These [parties] include brokers who work on behalf of market participants wanting to put a particular trade on. We dynamically incorporate these off-screen institutional trades with our broader auto-trading stack to optimise the execution and manage the major risks involved in the trade and wider portfolio. This process involves a lot of relationship-building, on-the-fly analysis and quick decision-making. – Graduate Trader @ Optiver

#3 Engineers

After traders, engineers are the other central role in trading firms. They're responsible for creating sophisticated systems that execute trades with lightning speed, analyse vast amounts of data accurately, and manage risks efficiently. Most firms have software engineers (learn more about their day-to-day) and some have hardware engineers too.

📣 Hear from a grad

After lunch, it’s time to get into some real development work. I spend most of my time reading code bases and designing code changes, marking sure the new features won't affect the current functionalities, and will fit the existing design style well. I learn a lot from reading the code base, many advanced techniques are used to achieve the ultra-low latency we have. – Graduate Software Developer @ Eclipse

What do traders do if so much of trading is automated?

The tools are only as good as the people using them! Traders need to check that they work properly, constantly improve them, and handle potential errors.

📣 Hear from grads themselves

Although trading ... is highly automated, traders need to understand the potential risks and deal with emergencies. For research, we analyse historical market data to improve the trading logic and base pricing of the instruments we trade. – Delta 1 Trader at Optiver

One continuous responsibility of mine is monitoring the performance of our auto traders. This ranges from determining if they are executing on the right signals to analysing aggregate trade data and improving our automated strategies. – Index Options Trader at Optiver

What are the hours at trading firms like?

Expect long hours, even if you work at a firm that values work-life balance. Grads tell us that they're usually in the office for around 10-11 hours a day, meaning at least 50 hours a week.

Their start and end times depend on the markets they cover. For example, the Australian Securities Exchange (ASX)

is open from roughly 10am to 4pm every day. So if you trade on it, expect to be there about 2 hours before the market opens and 2 hours after the market closes.

📣 Hear from a grad

[I get] to work at around 8am. As markets in Australia open at 10am, I have around 2 hours to prepare myself for the trading day ahead ... things usually wrap up between 6-7pm. – Trainee Trader @ Eclipse Trading

Traders like this who cover Australia tend to work the most "regular" hours, followed by those who cover Asian markets.

📣 Hear from grads themselves

The workdays are also quite structured compared to other jobs in the industry because there are clear market open and close times. Whilst after closing I will do some project work, there are no nights that I’m here into the late hours of the evening. – Quantitative Trader - Institutional (Japan Index Options) @ Optiver

I ... run the HK [Hong Kong] book with a senior trader. The HK market opens at noon, so I usually get in around 10.30 am on a typical day. ... The HK market ... closes at 7.30 pm, and we have some end-of-day processes to do, but they are usually done by 8.00 pm. Depending on how I feel, I may stay back a little longer to work on some research projects that I didn’t get to work on during trading. It’s usually a bit late [around 9.00 pm] by the time I’m done. – Delta1 Trader at VivCourt

Traders who cover US and European markets start and end the latest.

📣 Hear from grads themselves

[7:15 AM] Our office in Hong Kong ... hand over the global trading book to us for the European and US hours. ... [6:00 pm] I finish work on some of my projects and hand over the global trading book back to our Hong Kong office. – Graduate trader @ Maven Securities

I work US hours (~12-10) and as a result am unable to do as much on weekday evenings. – Graduate trader @ Maven Securities

On the bright side, there won't be work on the weekends, since markets are closed!

What's the best part of being a trader?

Traders favorite things about their job include the fast pace, instant feedback from the market, and the intellectual nature of the work.

📣 Hear from grads themselves

[S]ometimes opportunities arise where I am able to utilize all of my training and experience to make a split-second decision that could result in a big payout. I love the competitive nature of trading as well as the fact that it’s always fast paced and rarely boring, but because of that fast pace it’s not a very relaxing job. – Trader @ Maven Securities

The best thing about trading is its fast-paced nature and the constant feedback it provides. ... When the market is open, you are constantly looking for opportunities and ways to improve your trading. The market also provides instant feedback on any change you make in the form of good or bad trades and from then you’re in charge of utilizing the feedback to keep improving. Busy days can really be an adrenaline rush! – Trader @ Citadel Securities

My favourite part of trading is the number of different areas of academia it brings together. To be a good trader, you should have a good understanding of financial markets, statistics, machine learning and some basic scripting skills. At Vivcourt, there is a lot of interdisciplinary collaboration and plenty of opportunity for you to fit right into the niche you find most interesting! – Delta1 Trader @ VivCourt

There are many aspects of my work that I love! I enjoy the intellectual challenge and the technical conversations and projects that my team can engage with. It’s also very rewarding to have a tight feedback loop from the work you do and the success you can achieve. – Another Delta1 Trader @ VivCourt

What's the worst part of being a trader?

Across the board, grads mentioned the stress of the work and the long hours.

📣 Hear from grads themselves

Here, we've turned to anonymous reviews to give you the low-down:

Stress levels can sometimes be high with an apparent lack of care for wellbeing/balance. – Anonymous

Decent level of stress having to work in an intense environment with high expectations. – Anonymous

The weekly hours ... I work 50-60 hours, but the company is flexible. – Anonymous

Though keep in mind the high-pressure environment is what keeps some grads ticking!

📣 Hear from grads themselves

Trading can definitely be stressful, and you have to be able to think and react quickly in these situations as there is often a lot on the line. The stressful moments are also the most exciting though! – Trader @ IMC Trading

The biggest limitation of working in trading is the stress that can come from working in a live market setting. Some days will be naturally busier than others when some big news comes out and you have to react swiftly to a large market move. If you’re looking for a very low-paced job that allows you to coast day-to-day trading is probably not the industry for you. – Delta1 Trader @ VivCourt

Don't get me wrong; trading is a lot of fun, but it is also high pressure. That's what I love about the job, the intensity ... It is a quick, on-your-toes environment and it makes the day go all the faster! – Graduate Junior Trader @ Exponential Trading

One other limitation brought up was the highly regulated nature of the industry.

📣 Hear from a grad

The biggest limitation is navigating the complex legal and regulatory structures both within Citadel Securities and in the broader financial world. A large firm like Citadel Securities needs to operate in compliance with many rules and internal controls. This means that ideas that require trading new strategies or products must go through a rigorous approval process. Even for smaller ideas that don’t require as many approvals, you’ll often need to work closely with order traders to sanity check your idea before applying it to your trading. – Quantitative trader @ Citadel Securities

Finally, one grad mentioned that they found it "isolating" to be a woman at their firm.

📣 Hear from a grad

I am the only girl so sometimes can feel excluded.

How does your role evolve as you move up the ladder?

📣 Hear from a grad

When I first started, I supported and shadowed traders. I continued to grow my knowledge on the desk and in the education program and attended the market-making class where I learned SIG’s proprietary strategies. After class, I took on my own book to trade, the size and complexity of which continues to grow. I’ve also worked on non-trading related projects. The opportunities I’ve had to learn and grow are limitless. – Quantitative Trader @ SIG

Are there opportunities to work abroad as a trader?

Yes – In fact, here's a graduate trader who got sent to New York for training and then stayed there for a few years before coming back!

📣 Hear from a grad

I originally went to the US for 9-12 months of training, but that quickly turned into 18 months, which morphed into 3 years. After completing the initial training I stayed on in the US as a full-time trader, managing books in both single stocks and later indices. This took my experience to a whole new level. – Quantitative Trader @ SIG

Most of the top trading firms have offices overseas, so you can opt to work for those and experience different aspects of trading as well.

📣 Hear from a grad

There are lots of opportunities to move around the world and to trade different products in our Chicago and Amsterdam offices as well as Sydney. – Trader @ IMC Trading

Lastly, trading firms are known to hire globally (they just want the best talent!), so you also have the option of applying directly for an overseas firm and relocating there after graduating.